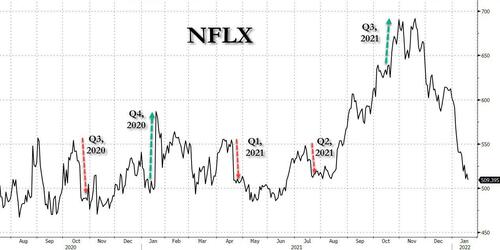

Recent earnings reports from streaming giant Netflix have been a mixed bag: the stock tumbled one year ago when the company reported a huge miss in both EPS and new subs, which at 2.2 million was tied for the worst quarter in the past five years, while also reporting a worse than expected outlook for the current quarter. This reversed four quarters ago when Netflix reported a blowout subscriber beat and projected it would soon be cash flow positive, sending its stock soaring to an all time high – if only briefly before again reversing and then tumbling three quarters ago when Netflix again disappointed when it reported a huge subscriber miss and giving dismal guidance, leading to the second quarter when Netflix slumped again after the company missed estimates and guided lower. This again reversed last quarter when Netflix soared after it blew away expectations and guided to a whopper Q4.

Which brings us to today, when after hitting an all time high around $700 in November, the stock slumped to the middle of its range for much of the past two years, with investors on edge to find out not whether the company would confirm its impressive guidance and continue its torrid growth pace. Said otherwise, how many new subscribers did Netflix add in the third quarter… and will Netflix’s “monster quarter for content” translate into outsize subscriber gains? That’s the question Wells Fargo analyst Steven Cahall asked in a research note Wednesday.

Unfortunately for NFLX bulls, the answer was a resounding no, because despite beating modestly on revenue and EPS, NFLX missed on Q4 streaming adds, but more importantly, its Q1 subs forecast was an absolute disaster, and at just 2.50 million it was nearly 4 million below the street’s estimate of 6.26 million.

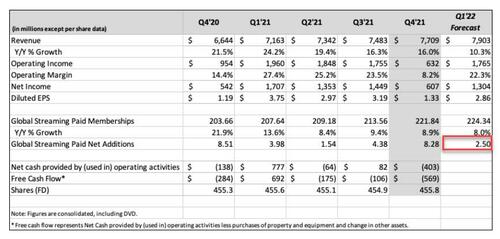

Here is what NFLX just reported for Q4.

- EPS $1.33, beating est. 81c

- Rev. $7.71B, matching est. $7.71B

- Operating margin 8.2% vs. 14.4% y/y, beating the estimate 6.96%

- Operating income $631.8 million, down 34% y/y, but also beating the estimate $559.0 million

- Negative free cash flow $569 million vs. negative $284.0 million y/y, missing the estimate of negative $516.8 million

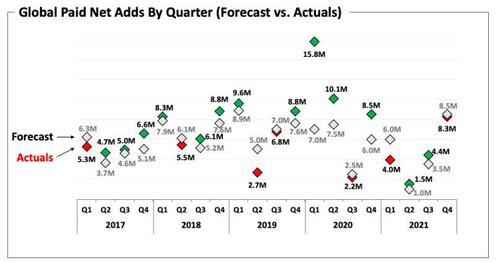

So far so good, or at least not terrible. But this is where the wheels comes off, because while the company had previously forecast 8.5 million Q4 paid subs, it achieved just 8.28 million (which still was just above the Wall Street’s downward revised estimate of 8.13 million), down 2.7% Y/Y…

This is how the company explained this miss:

We slightly over-forecasted paid net adds in Q4 (8.3m actual compared to the 8.5m paid net adds in both the year ago quarter and our beginning of quarter projection). For the full year 2021, paid net adds totaled 18m vs 37m in 2020. Our service continues to grow globally, with more than 90% of our paid net adds in 2021 coming from outside the UCAN region.

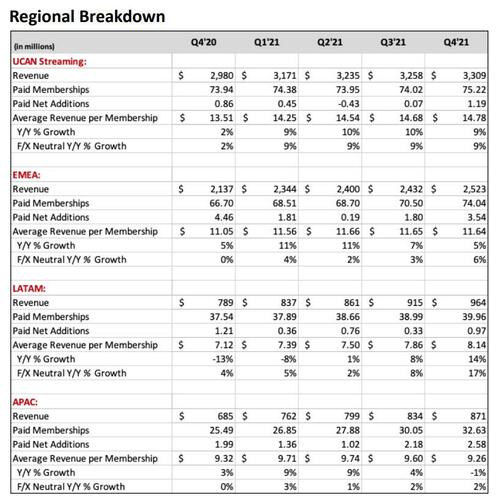

The Q4 subscriber miss was broken down as follows:

- UCAN streaming paid net change +1.19 million, +38% y/y, beating the estimate +596,839

- EMEA streaming paid net change +3.54 million, -21% y/y, beating the estimate +3.45 million

- LATAM streaming paid net change +970,000, -20% y/y, missing the estimate +1.23 million

- APAC streaming paid net change +2.58 million, +30% y/y, missing the estimate +2.91 million

The punchline: in the US, subscribers had a small gain in the U.S. and Canada — from 74 million in 3Q to 75.2 million in 4Q. Netflix saw bigger growth in EMEA than in North America: from 70.5 million subscribers in 3Q to 74 million in 4Q. And some more context: more than 90% of Netflix’s net adds in 2021 came from outside the U.S. and Canada.

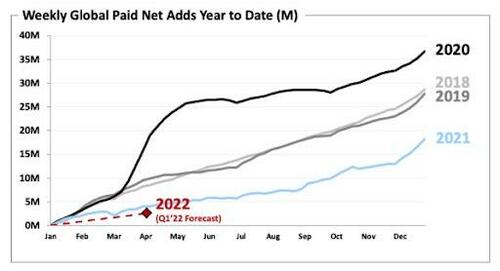

But the real gut punch was the company’s Q1 2022 guidance, where the company not only saw revenue of $7.9 billion, far below the $8.12 billion estimate, and EPS of 2.86 which was also below consensus of $3.37, but the worst of all is that the company now expects just 2.50 million streaming paid subs this quarter, some two-thirds below the consensus of 6.26 million, bringing the company’s total subs to just over 224 million. This would be the worst start to a year since at least 2017!

Bloomberg Intelligence says Netflix’s underwhelming 4Q subscriber additions and weak guidance for 2.5 million gains in 1Q (vs. consensus’ 6.3 million) cast doubts on the long-term growth trajectory and fuel concerns that the service may have reached saturation in many markets. “Flattish operating-margin guidance for 2022 may compound negative sentiment despite a return to breakeven free cash flow.”

Netflix blamed this lower-than-expected Q1 forecast on new programming, such as “Bridgerton” season two, not coming until March. Subscriber growth hasn’t returned to pre-pandemic levels, partly due to a “Covid overhang” and partly due to economic hardship, particularly in Latin America, the company said.

And here is the carnage in table format:

This, as Stanphyl Capital notes, explains why NFLX just announced a big price increase – the growth is gone, so it has to start maximizing revenues in more conventional ways.

Now you know why $NFLX just announced a big price increase…

It's got to start milking the subs it's got, as it can't grow enough any more by getting new ones.

— Stanphyl Capital (@StanphylCap) January 20, 2022

Looking at the slump in the streaming part of Netflix business, Bloomberg writes that investors likely want to hear something more concrete and “much more transformative” on the gaming front, particularly after Microsoft’s planned acquisition of Activision Blizzard and the Take-Two-Zynga deal. Netflix has made some moves, including the purchase of Night School Studio, “but I’m not sure that’s going to move the needle for them.”

To be sure, it wasn’t all dismal news: Netflix reported its series accounted for six out of the 10 most searched shows globally. Those included ‘Squid Game,’ ‘Bridgerton,’ ‘Cobra Kai,’ ‘Sweet Tooth,’ ‘Lupin,’ and ‘Ginny and Georgia.’

In another ominous twist, instead of focusing on the potential market share, Netflix was surprisingly honest when addressing the competitive landscape saying that “consumers have always had many choices when it comes to their entertainment time – competition that has only intensified over the last 24 months as entertainment companies all around the world develop their own streaming offering.” And then there’s this clear admission that competition is starting to hammer NFLX: “While this added competition may be affecting our marginal growth some, we continue to grow in every country and region in which these new streaming alternatives have launched.” At this point the narrative fell back to the familiar “growth” chatter: “This reinforces our view that the greatest opportunity in entertainment is the transition from linear to streaming and that with under 10% of total TV screen time in the US, our biggest market, Netflix has tremendous room for growth if we can continue to improve our service.”

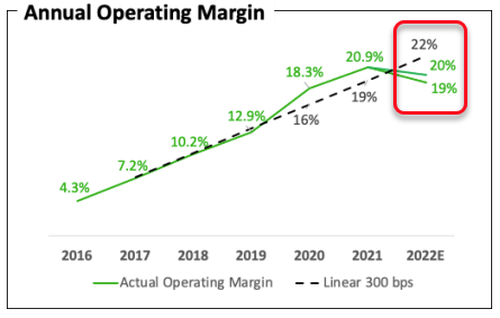

But wait, there was more bad news news, as the company projected that for 2022, it is currently targeting an operating margin of just 19%-20%, explaining that its operating margin outlook is driven by two main factors.

- First, as seen in the chart below, we delivered above the three percentage point annual linear progression over the past two years (average of four percentage points per year).

- Second, NFLX said that the US dollar “has strengthened meaningfully against most other currencies. With ~60% of our revenue outside of the US due to our international success, we estimate that the US dollar’s appreciation over the past six months has cost us roughly $1 billion in expected 2022 revenue (as a reminder, we don’t hedge).” Well… maybe it’s time to hedge!? And so with the vast majority of our expenses in US dollars, this translates into an estimated two percentage point negative impact on our 2022 operating margin.

In hopes of easing investor fears, the company said that as it has written in the past, “over the medium term we believe we can adjust our pricing and cost structure for a stronger US dollar world. In the near term, we want to continue to invest appropriately in our business and don’t want to over-react to F/X fluctuations to the detriment of our long term growth. There is no change to our goal of steadily growing our operating margin at an average increase of three percentage points per year over any few year period”

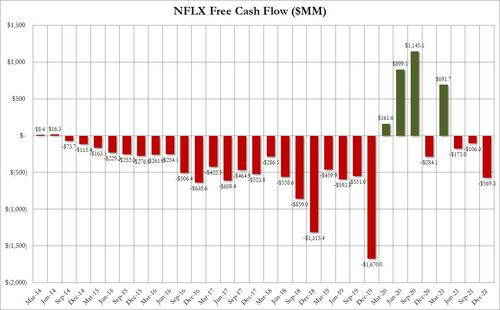

As usual, the company’s cash burn was topical, as NFLX burned another $569 million in the quarter. This is what it disclosed in the letter:

Net cash generated by operating activities in Q4 was -$403 million vs. -$138 million in the prior year period. Free cash flow (FCF) for the quarter was -$569 million vs. -$284 million in Q4‘20. For the full year 3 2021, FCF amounted to -$159 million, in-line with our expectation for “approximately break-even.

We anticipate being free cash flow positive for the full year 2022 and beyond. As a reminder, we prioritize our cash to reinvest in our core business and to fund new growth opportunities like gaming, followed by selective acquisitions. We’re also targeting $10-$15 billion of gross debt. We finished Q4 with gross debt of $15.5 billion and we’ll pay down $700 million of our senior notes due in Q1’22. After satisfying those uses of cash, excess cash above our minimum cash levels will be returned to shareholders via stock repurchases.

Blah blah blah: here is the bottom line – the only time Netflix has been cash flow positive in its entire history was when covid shut down the world. And now, covid is over and the company has pulled forward some 5 years of demand. Good luck.

And sure enough the market seems to agree – in light of all these dismal developments, led by the catastrophic subscriber guidance, which is payback for years of pulled forward demand thanks to stimmies and omicron, the stock is cratering after hours tumbling over $100 or a whopping 20% after hours to $411. Putting this in context, the stock was at $700 on November 17, barely two months ago.

Today’s drop means NFLX is down the most since its Oct. 2014 earnings plunge, and has wiped out two years of gains.

If bulls were hoping for some cheerful pep talk, they’ll be disappointed by the following quote from Miller Tabak’s Matt Maley: “NFLX had already declined 26% before they reported earnings. A lot of people hoped that the earnings report would be the catalyst for a rally in this stock — the first FAANG stock to report earnings. Instead, it’s falling even further, so that’s going to take even more confidence away from investors.”

And while NFLX just lost 20% of its market cap, at least its (poorer) shareholders get some forceful ESG statements:

What was the saying, “get woke, go broke”?

Via Zerohedge